In the aftermath of the COVID-19 crisis and subsequent historic spike in equity volatility, corporate bond downgrades, and record low interest rates, many multi-asset income portfolio managers are re-evaluating how to mitigate the risks that arise from seeking yield.

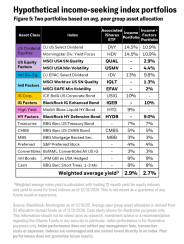

Deriving an assumed global multi-asset allocation from the peer group average, two hypothetical index-based portfolios were constructed.

- Income: The asset allocation is populated with dividend-focused equity and broad-market fixed income indexes. This represents a typical income-seeking multi-asset portfolio.

- Income + Factors: Seeks to enhance the Income portfolio by allocating 25% of equities to factor indexes and fully replacing traditional corporate bond indexes with factor-based indexes.

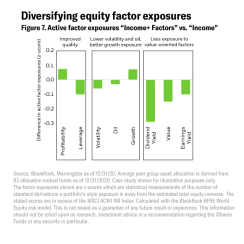

- Diversifying factor and sector biases

- Maintaining a similar level of yield

- Improving risk-adjusted performance

The weighted average yield (above) shows that allocating a portion of the portfolio to factor-targeting strategies may maintain a similar level of yield.

“When there are pooled funds within a multi-asset strategy, there’s often so much diversification that it looks like the index – there aren’t significant active bets. Individual active managers are being active, but their positions in aggregate lower the overall active risk of the portfolio, and the chances of outperforming are reduced. As they begin to use factors, they can differentiate exposures from their current active strategy. So, if they’re willing to reduce allocations to some of those active strategies and use a factor ETF, they can increase their active risk level and their chances of outperforming. Investors and managers often haven’t conceptualized this because ETFs are sometimes seen solely as vehicles for broad-base indexes.” – Del Stafford, Head of iShares Portfolio Consulting, BlackRock

“One area that hasn’t been widely considered by income-seeking investors is to use factor strategies and factor ETFs to complement traditional sources of income. Using factor ETFs can lead to a more robustly constructed portfolio, and in some cases, even greater income as measured by dividend yields or cashflow payouts. In the first half of 2020 we saw very large drawdowns to traditional multi-asset income funds because they have large sector overweights, in particular to the real estate, energy, and utility sectors. Those sectors traditionally offer high yields, but they have potentially large sensitivities to changes in interest rates and economic growth, and to potential policy shocks – three things we had in abundance in early 2020. Those large sector overweights potentially drive higher volatility and risk, and factor ETFs can help diversify that risk while helping investors manage the downside and maintain similar or higher levels of yield. We can do that in both equities and fixed income.” – Andrew Ang, Head of Factor Investment Strategies, BlackRock

FOR INSTITUTIONAL USE ONLY - NOT FOR PUBLIC DISTRIBUTION

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain quantitative investment characteristics ("factors"). Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. In such circumstances, a fund may seek to maintain exposure to the targeted investment factors and not adjust to target different factors, which could result in losses.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective. The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

Prepared by BlackRock Investments, LLC, member FINRA.

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by MSCI Inc., nor does this company make any representation regarding the advisability of investing in the Funds. BlackRock is not affiliated with MSCI Inc.

©2020 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

iCRMH0221U/S-1458009