There is emerging evidence that ESG momentum can be a significant source of alpha over time. This premise identifies causation from change in the ESG fundamentals of a company, which are eventually reflected in their ESG scores, to its future stock price performance. This can take place via an increase in profitability and/or reduction in discount rates. As a result, by identifying changes in ESG fundamentals, investors may be able to increase the chance of “doing well by doing good.”

ESG scores assigned to companies are useful in this regard, but like any other scores they come with challenges in terms of availability, accuracy, and consistency. For example, the number of companies covered by ESG data vendors isn’t maximized given limited disclosure, especially in Japan. Most importantly, just like financial information, scores themselves may be priced in as soon as they are released. Ideally, therefore, any underlying structural change in ESG fundamentals should be identified before it is reflected in ESG scores. This is easier said than done, however.

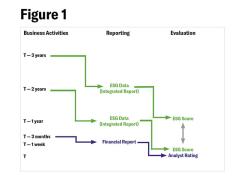

In practice, there should be a significant time lag between the underlying structural change in ESG fundamentals and the resulting change in ESG score (see in figure 1). While some firms may simply need to better understand rating agency requirements, others are required to engage in long-term structural reform which, if identified early on, can allow investors to benefit from increasing valuations. Therefore, long-term perspective is essential.

Further, faced with a large investable universe, identifying which companies are most likely to benefit from ESG momentum is daunting – especially in Japan, where the universe contains more than 3,700 listed companies. The task is made even more difficult by Japan’s unique corporate culture and language barrier. Long-term experience in direct fundamental bottom-up research is therefore essential.

Yet many of these changes may not materialize despite the best intentions of corporate management. Some Japanese companies that would like to embark on ESG strategies just don’t know how to get started. In addition, new and improved ESG strategies are often met with skepticism by investors, which may discourage companies from proceeding. But when a company’s management expresses a desire to improve its ESG fundamentals, they are often more receptive to advice from investors like SPARX Asset Management, which in turn can help influence investors who, through active engagement, may be able to dramatically raise the chance of a company making real progress over the long run.

A fundamental approach

To take advantage of ESG opportunities, there is an important role to be played by a fundamental bottom-up stock picker with a long-term investment horizon. Indeed, SPARX strongly believes that a combination of structural understanding, bottom-up stock selection, and active engagement can capture ESG momentum in Japanese companies, as illustrated below.

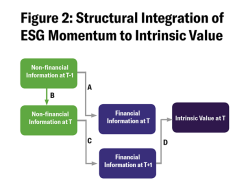

Essentially, through fundamental bottom-up research we capture in advance what we anticipate ESG scores could be in the future, and apply the structural relationship that we learn to make a long-term financial forecast to estimate the intrinsic value. Let’s take a deeper dive into the above illustration.

- Non-financial Information at T-1 to Financial Information at T (A)

We first gain an understanding of the relationship between ESG, earnings, and cost of capital. To do so, we check available past non-financial information, including integrated reports, websites, third-party ESG scores, and other company/competitor cases based on our 30 years of experience.

- Non-financial Information at T-1 to Non-financial Information at T (B)

We check any changes in ESG by following the most recent news releases and conducting meetings. We meet with the company IR team and the management if possible, to check the future direction of their ESG activities. As a result, we often notice changes happening to companies. Most asset managers and investors use only quantitative screening. Our culture and history as an independent active manager are critical to successfully implementing this step.

- Non-financial Information at T to Financial Information at T+1 (C)

We utilize what we learn to make a mid- to long-term financial forecast. Through IR meetings, we check whether the management strategy integrates ESG factors, and the team discusses the feasibility of the management strategy based on their track record. For more than 30 years, SPARX’s investment approach has focused on qualitative aspects of the underlying business fundamentals to make long-term forecasts. What we do today with ESG is a natural integration with our 30-year investment approach.

Throughout our investment process, we believe that active engagement plays an important role in raising the chance of a company making real progress over the long run.

We place tremendous importance on discussions with companies to determine if they have built a foundation for sustainable growth by establishing strong relationships with shareholders, employees, business partners, local companies, the global environment, and all other stakeholders. If we see the potential for improved corporate value as a result of these dialogues, we demonstrate our support for management by actively investing in such companies. When necessary, we exercise our shareholder rights during general shareholders' meetings to actively motivate corporate management. Conversely, if after such discussions a company makes no changes to a management strategy that hinders sustainable growth, then we end our investment by selling all shares to protect the profits of the strategy’s investors. In short, our engagement activities revolve around dialogues that are meant to build strong relationships with the companies.

The adoption of coaching elements in our discussions has been particularly effective. Coaching is a communication skill meant to motivate the other party, and it helps spur investee companies to become more active because of our meetings. Based on the awareness levels of a company’s executives and IR managers and the specifics of its management issues, we determine whether coaching is appropriate (there are situations in which it could be unsuitable). When appropriate, we ask companies a series of questions to have them set goals, to consider their current situations in regard to these goals, and to create action plans to fill the gaps. After these meetings are over, companies reflect on their new insights, and if they ask for our opinion, we provide it. For the last couple of years, most discussions have been on ESG-related matters, and some of the companies with which we have spoken have held ESG briefings or improved their integrated reporting processes. These are the results of forward-looking corporate actions.

We expect two major types of results from our engagement – improving fundamentals and eliminating the value gap. The key issues for improving fundamentals are business models, financial strategies, and ESG strategies. Because these are companywide strategies, it is challenging to encourage change when top executives are not conscious of these issues. On the other hand, it is effective to back companies that are already highly aware of these issues. “Eliminating the value gap” means to eliminate a situation in which, for some reason, a company’s share price is lower than its intrinsic value. The main issues in such situations are IR strategies, ESG information disclosure, and corporate brand strategies. To create awareness among top executives, practical IR activities are also a key element, so we emphasize discussions with IR managers as well as with executives.

So far, our discussions as described have shaped our view of sustainable investing in two ways. First, companies with the potential to improve their ESG fundamentals are often undervalued and should therefore provide opportunities to generate unique alpha. Second, we advocate an integrated ESG approach where fundamental bottom-up analysis includes ESG considerations with active engagement. This resonates with SPARX’s fundamental bottom-up stock picking approach with a long-term mindset.

CASE STUDY: NINTENDO

Since its founding in 1889, Nintendo has operated a business centered on developing and manufacturing entertainment products. As expressed through its CSR policy of “Putting Smiles on the Faces of Everyone Nintendo Touches,” Nintendo’s history is one of growth through getting more people involved and making them happier.

Nintendo tends to have significant earnings volatility, depending on the success of its entertainment products. For example, the firm had three consecutive years of losses (FY3/2012 through FY3/2014) due to the subpar sales performance of the Wii U, the successor console to the blockbuster Wii. From an investor’s perspective, the stability and predictability of Nintendo’s earnings structure are causes for concern, and that has impacted SPARX Asset Management’s decision to make the company a long-term investment.

More recently, SPARX began to reconsider investing in Nintendo, seeing signs that business and external environmental changes over the past five years could contribute to improved profitability and growth potential for the firm. In 2015, under a new company president, the firm revised its basic policy from expanding the gamer population to increasing the number of people who enjoy Nintendo content. The strategy increased focus on Nintendo Switch, specifically its lifecycle and user engagement, launching new titles on a schedule that sustains business momentum. In the process of achieving this, Nintendo combined two separate development systems – one for handheld systems (like Nintendo DS) and one for consoles (like the Wii) – to concentrate its resources on the Nintendo Switch. The company has also created new revenue streams through online membership services and by launching a new revenue model based on membership fees.

In the course of its research into Nintendo, SPARX discovered that changes in the external environment were beginning to provide a tailwind for the company, as well. For example, in 2019, its lead developer, Shigeru Miyamoto, was selected as a Person of Cultural Merit, an official Japanese honor awarded to those who have made outstanding contributions to the nation’s cultural development. This signaled that gaming is starting to gain cultural credibility. In addition, the COVID-19 pandemic has created a need for people to relieve stress while they are stuck at home. The World Health Organization (WHO), which once warned about gaming addiction, has reversed its position and started a campaign to promote gaming.

Based on its research, SPARX observed a change in the economic value of Nintendo. A new management team altered the company’s operational quality. Operational changes resulted in concrete strategic decisions on lengthening product lifecycles and improving user engagement , and the firm has begun to improve the quality of its earnings through higher profitability and more stable performance. In addition, society at large has increasingly recognized the cultural aspect of games and their value as a communication tool, leading to greater medium- to long-term market growth potential than before.

Finally, before investing in Nintendo, SPARX calculated Nintendo’s corporate value to reflect the factors mentioned, and concluded that it is higher than the company’s share price. In doing so, SPARX raised its earnings forecast for Nintendo, taking into account market growth and higher profit margins, and also lowered its discount rate to reflect the decrease in the earnings volatility risk factor.