A forward-looking report8 from PwC written in 2015 anticipated what the alternative asset management landscape would look like in 2020, and had this to say: “By 2020 … leading alternative firms will have laid the necessary plumbing, and accessing data across their organizations will be as natural as turning on a tap.”

This was a bold projection when, according to another report9 from roughly the same time, “Data management has also proven to be a vexing challenge for many firms. One out of three LPs now expect GPs to provide for data mapping into their portfolio monitoring systems.”

Effective data management relies heavily on technology, which in itself is ever improving. Keeping up can be costly, and even for larger firms with deep pockets, that can be a challenge. And if LP expectations back in 2015 were “vexing,” a 201910 survey showed how much so by revealing that only 1 in 10 asset owners were willing to pay more for managers that use big data in their investment research and idea generation (as opposed to managers that do not use big data for same). If that doesn’t vex managers, this certainly will: in response to the same question, 10% of investors said they expected to pay less.

GPs up their reporting game – sort of

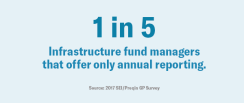

As noted earlier, institutional investors expect new levels of transparency from traditionally opaque GPs, particularly in performance attribution and operating expenses. Reporting frequency can vary significantly by asset type, and the lack of standardization can make it challenging for firms moving into a new asset class. According to one 2017 study, monthly reporting is standard among hedge funds, although a small number (1 in 10) provide weekly reports. Quarterly reporting is much more common for private equity, private debt, and real estate funds. Infrastructure investments tend to produce the least frequent reports. For them, quarterly is standard, but one out of five infrastructure managers only offer annual reporting.11

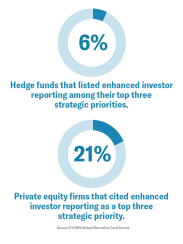

Perhaps the necessity to meet investor expectations on reporting is in the eye of the manager. Only 6% of hedge funds in one study12 listed enhanced investor reporting among their top three strategic priorities for the firm. Same study, same question, a much larger 21% of private equity firms said it was a top three strategic priority. As a more “traditional” and liquid alternative product, hedge funds possibly feel they have sufficiently addressed reporting as they’ve been answering questions about it for a longer period of time.

Many firms are moving beyond periodic reports by offering some combination of customization and online access. For example, tailored reports were offered by approximately two out of three alternative managers in 201613 and in a more recent survey the top five types of custom reports were: one-off bespoke reporting upon request; risk and compliance; full position level transparency; open protocol; and, standard reports in tailored formats.

With more resources and a higher percentage of institutional investors, larger and more diversified firms are more likely to offer customizations than their smaller competitors. Online account access is still far from universal, and is more commonly offered by larger firms, particularly those managing multiple asset classes.14

Attuning to customization

Customization is almost surely central to the future of alternatives. More than seven out of every 10 firms plan to offer customized investment vehicles, with many planning to launch co-investment vehicles, separately managed accounts, or other structures.15 The abundance of investment vehicles – customized or standard – is likely to test the personnel, processes, and profitability at many firms. Outsourcing relationships will become more critical and investments in technology internally will need to be judicious.