Consistent with its decades serving the retirement needs of clients, MassMutual is an expert provider in the defined contribution (DC) investment-only space. It makes sense, because investing for retirement requires a certain DNA and investment philosophy. The entire MassMutual Investments platform is centered around retirement-oriented outcomes, which the firm feels is best pursued by embracing a multi-manager philosophy.

Why multi-manager?

Greater potential for more consistent, risk-sensitive, long-term performance. This is especially important for helping retirement investors minimize the behavioral biases that often lead to sub-optimal investment decisions. Staying appropriately invested throughout market cycles enhances their ability to meet retirement needs.

Sophisticated and rigorous manager selection and monitoring processes. An emphasis on risk management helps alleviate concerns about manager performance.

Portfolio construction with specific purposes, allowing for outcomes that are more closely aligned with investors’ needs.

Access to a greater range of managers without overwhelming plan participants with options. That’s important, because data suggests that 401(k) plan participants suffer from “choice overload.”

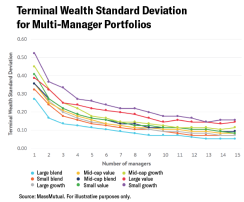

Several studies have shown that the diversification benefits from multi-manager funds help investors meet their accumulation needs. While diversification doesn’t protect against loss in a declining market, the expected portfolio value at the end of the investment horizon (terminal wealth) is paramount – not the ups and downs in portfolio returns over the investment period. The chart below exhibits the reduction in the standard deviation of terminal wealth in portfolios in specific asset classes when additional managers are added. The lower the standard deviation, the lower the risk associated with having an unexpected shortfall heading into retirement.

For all equity asset classes measured, the standard deviation of terminal wealth fell significantly by adding managers to the portfolio. The most risk control from manager diversification is gained in portfolios with two to three managers. The incremental benefit of adding managers beyond this number decreases as the number of managers rises.

Building the multi-manager portfolio

MassMutual selects “best in class” asset managers in their respective investment style with the goal of identifying managers that can consistently deliver positive, long-term results while limiting volatility. The best-of-the-best are determined through rigorous quantitative and qualitative screening, ongoing interviews with the target firm’s management and professional staff, and assessments of the firm’s compliance organization, policies and procedures, code of ethics and regulatory history. This process includes an evaluation of the sub-advisors risk management, compliance and operations functions.

In building its multi-manager portfolios, MassMutual selects managers that invest within the same asset class but with unique and complementary styles. As a result of differentiating views on stock selection and portfolio construction, these managers will typically have minimal overlap in holdings and low correlation of excess returns.

Here are a few examples of how pairing managers in this way allows portfolios to benefit:

- Style diversification: Managers with different styles diversify the sources of returns.

- Larger opportunity set: Fund holdings are likely to be diversified across a wider selection of securities, with exposure to a broader range of holdings characteristics.

- Business risk diversification: Many factors may influence the performance of a single manager including turnover, investment process drift, change in ownership structure, etc. Engaging multiple managers diversifies these risks.

- Allocation of capital across managers within the funds is strategic and determined through a disciplined process that incorporates both quantitative and qualitative elements.

- Historical returns for each manager are examined alongside its complementary manager pairing, and in a stand-alone capacity.

- The process examines risk and return in various market regimes recognizing that a manager’s style varies in efficacy throughout market cycles and reacts differently to positive and negative market events.

- Qualitatively, MassMutual incorporates deep insight into the manager’s strategy and style generated by its dedicated Manager Research Team.

- Combining these two additive portfolio construction approaches has helped MassMutual achieve more durable and persistent returns on behalf of its clients.