In the pre-Covid 19 world, institutional investors’ penchant for alternative investments showed no signs of slackening. While the pandemic hasn’t necessarily affected that fervor, it has seen some investment boards clicking pause on alternative allocations, and the relationships between some GPs and LPs is almost certain to experience some new pain points as the challenge continues. To that end, this special report will focus on how key operational areas can be leveraged to strengthen relationships between alternative investment management firms and their investors.

First let’s take a look at the state of play: In a global survey of asset owners conducted by Institutional Investor1 after the Covid-19 pandemic shuttered much of Europe and the U.S., about 60% said it was too soon to tell what might be the most attractive risk-adjusted buying opportunities in private markets. In interviews for the survey, one investor in alternative funds said that “if valuations [of alternatives] don’t come down as much as they did in public markets,” allocation levels would be maxed out, taking new private markets deals off the table while valuations filter in over the next six months.

Another investor said this had already happened at his fund. “Our soft limits on alternatives have been hit, so the board has pulled the emergency brake on the deal pipeline of structured credit, private equity secondaries, and so on. It’s frustrating.”

Writing in International Investment, Ryan McNelley, a managing director in Duff & Phelps’ portfolio valuation practice, noted that “in private markets, GPs and LPs are grappling with the impact on the value of portfolios. While the dislocation could signal a buying opportunity for private equity, distressed debt, and special situations funds in particular, many GPs will be focused on protecting the value of their portfolio companies.” With the economic impact of the crisis “only just starting to filter through,” writes McNelley, “this leads to potentially difficult discussions between GPs and LPs.” On the LP side, defaults could increase if opportunities arise due to depressed prices and LPs cannot respond to capital calls.

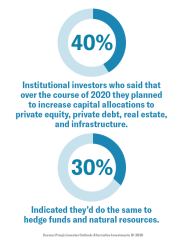

Reasons for investors’ well-documented increased commitment to alternatives range from improved portfolio diversification to less correlation with other asset classes. The appetite for alternatives remained undiminished in the lead up to the current crisis – nearly 40% of institutional investors said that over the course of 2020 they planned to increase capital allocations to private equity, private debt, real estate, and infrastructure, and nearly 30% indicated they’d do the same to hedge funds and natural resources. Similar intentions were expressed for allocations over the long term, as well.2

GPs know the important role they play for their investors. With tough conversations with LPs to come, and many investors likely to reassess manager performance as the crisis lessens, it’s a good time for alternative investment managers to take a look at the inner workings of their shop beyond their core excellence in sourcing deals and portfolio construction and management. By doing so, GPs can create efficiencies that allow them to devote more time to investment decisions, and at the same time, strengthen their relationships with investors – two things they will benefit from in the future.