401(k) plans are entering a new phase: an era of decumulation. More assets are now flowing out of America’s 401(k) plans than being contributed from participants’ paychecks.4 And with that change, plan sponsors now find themselves shifting focus to helping retiring participants understand and meet their retirement spending needs.

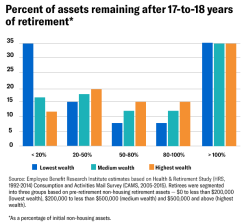

As noted in the interview above, recent reports from BlackRock in conjunction with the Employee Benefit Research Institute (“EBRI”) found that across all wealth levels, most current retirees still have 80% of their pre-retirement savings after almost two decades in retirement. Digging deeper, across all wealth levels measured, more than one third of current retirees actually grew their assets – leaving considerable potential retirement income on the table.

Looking forward: retirees may need to spend down their assets

Many of the retirees captured in this research were fortunate to be able to maintain a reasonable standard of living without significantly tapping into their retirement savings principal. This may not be the case for future retirees as a result of:

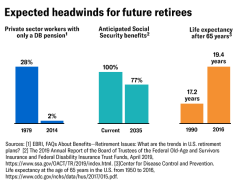

- Pension benefits: On average, 42% of the retirees tracked in the research received income from a DB pension plan; few, if any, of those retiring over the next 10-20 years can expect income from a DB plan.5

- Social Security: Income from Social Security is the largest component in the retirement income mix for all retirees, but pressure on Social Security finances could lead to a future drop in benefits.6

- Rates of return: Over the past 35+ years, a broad array of asset classes delivered robust returns; at BlackRock, we believe fewer asset classes are expected to perform at the same levels in the future.

- Savings behavior: Future retirees may be more dependent on their savings than previous generations, and they may need to develop strategies for drawing down their retirement assets.

- Longer life span: People are living longer and will need to have their retirement assets last longer, in some cases much longer.7

Shifting demographics and a more challenging market environment will only elevate the complexity and importance of helping retirees maximize the value of retirement savings. But with improved savings behavior, steady and consistent investing, and education on how to generate retirement income, we believe future retirees can take the steps necessary toward a comfortable standard of living.

To learn more about preparing for the shift to retirement spending, download the full paper.

- GAO, “Survey of Consumer Finances,” 2016; Health Affairs, “The Financial Burden Of Paid Home Care On Older Adults: Oldest And Sickest Are Least Likely To Have Enough Income,” 2019

- https://www.bloomberg.com/opinion/articles/2017-06-05/tackling-the-nastiest-hardest-problem-in-finance

- https://www.census.gov/newsroom/press-releases/2018/cb18-41-population-projections.html

- Employee Benefits Security Administration, U.S. Department of Labor. Private Pension Plan Bulletin Historical Tables and Graphs 1975-2016, December 2018, p. 25, https://www.dol.gov/sites/default/les/ebsa/researchers/statistics/retirement-bulletins/private-pension-plan-bulletinhistorical-tables-and-graphs.pdf

- EBRI, FAQs About Benefits—Retirement Issues: What are the trends in U.S. retirement plans?

- The 2019 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds, April 2019, https://www.ssa.gov/OACT/TR/2019/index.html.

- Center for Disease Control and Prevention. Life expectancy at the age of 65 years in the U.S. from 1950 to 2016, https://www.cdc.gov/nchs/data/hus/2017/015.pdf.

This material is provided for educational purposes only and should not be construed as research. The information presented is not a complete analysis of the global retirement landscape. The opinions expressed herein are subject to change at any time due to changes in the market, the economic or regulatory environment or for other reasons. The material does not constitute investment, legal, tax or other advice and is not to be relied on in making an investment or other decision.

Investing involves risk, including possible loss of principal. Asset allocation models and diversification do not promise any level of performance or guarantee against loss of principal. Investment in target date funds is subject to the risks of the underlying funds. The target date is the approximate date when investors plan to start withdrawing their money. The principal value of a fund is not guaranteed at any time, including at and after the target date.

The opinions expressed in third party articles or content do not necessarily reflect the views of BlackRock. BlackRock makes no representation as to the completeness or accuracy of any third party statement.

No part of this material may be reproduced, stored in any retrieval system or transmitted in any form or by any means, electronic, mechanical, recording or otherwise, without the prior written consent of BlackRock. This publication is not intended for distribution to, or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

©2020 BlackRock, Inc. All Rights Reserved. BLACKROCK and LIFEPATH are trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners

MKTGH0920U-1327262