What are the key factors in investing with diverse managers? Are the sourcing and investment processes the same compared to more established managers? What might be gained, and what are the risks? The GCM Grosvenor team that focuses on investing with diverse private equity managers was established in 2007 and has focused on sourcing, sharing best practices, and allocating capital to diverse private equity managers. During this time, they have helped numerous corporate and public pension plans and other institutional investors build diverse manager programs from the ground up.

Thing You Should Know #1: There is Increasing Interest in Investing with Diverse Managers.

- There is ample evidence that investing with diverse managers is good business. Surveys, studies, and GCM Grosvenor research and experience support diverse managers’ ability to produce attractive risk-adjusted returns and the potential to generate alpha. 0 One recent study conducted by the National Association of Investment Companies (NAIC) notes that its universe of diverse manager funds reliably outperformed relevant benchmarks over long time horizons.1 The study attributes performance primarily to smaller fund sizes, differentiated deal flow, and managers’ investments in first-time funds.

- People of color manage less than 1.5% of the $69 trillion AUM in the asset management industry.2

- Many endowments, foundations, and pension funds (and the entities that govern them) continue to highlight the importance of equal access to capital in their investment programs. Some investors are influenced by external sources like regulatory requirements. Others may be influenced by C-suites, boards, and trustees who realize the diversity of their investment management falls short of the progress they have made toward diversity in other parts of their businesses.

- There has also been a new wave of interest among investors who have been sparked by the increased focus on racial justice in the U.S. and globally. These investors tend to emphasize underrepresented minorities, such as African Americans and Hispanics. Given the current dialogue, limited partners, corporations, foundations, and others are exploring how they can leverage their influence and investments to ensure equal access to capital.

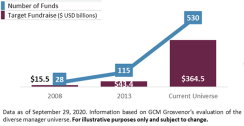

- The population of diverse manager talent is much deeper than in prior years. People of color and women have risen to more senior levels of established firms, giving them the experience and track records to launch their own funds. The number of funds launched by diverse private equity managers has increased significantly since 2008.

Investors who have seen success by including diverse, small, and emerging managers in their portfolio have a thorough knowledge of the diverse manager universe. They frequently meet with managers and are proactive in sourcing talent rather than relying solely on placement agents or general partners (GPs) that approach them. Doing so helps build their reputations as investors that are accessible to diverse managers. GCM Grosvenor has an “open-door” approach toward meeting diverse managers, which has allowed it to see hundreds of opportunities and commit more than $1 billion to diverse private equity managers in 2020.

In the GCM Grosvenor team’s experience, successful LPs immerse themselves in the diverse manager community and actively participate in relevant industry organizations. Firsthand observation indicates that being involved with associations of diverse professionals can create new relationships and strengthen existing ones. GCM Grosvenor typically sponsors or attends more than 25 industry conferences per year and hosts two premier industry events that spotlight diverse and emerging managers. Fostering a community in the diverse manager space remains important during the current global pandemic. The firm’s hosted events have shifted to virtual settings and it remains committed to sponsoring and attending other virtual industry events.

Established investors in this space also can consider managers with complex stories or shorter track records. These LPs are prepared to invest early in funds that may be smaller and less well-known and can often move quickly to execute co-investments with managers.

Finally, LPs in this space often have diversity on their boards and investment teams. This isn’t necessarily a requirement, but there’s an element of “walking the walk” in doing so.

Thing You Should Know #3: Even When Short of Resources, LPs Can Still Invest with Diverse Managers.

Investors can supplement their efforts by working with an advisor or consultant at varying levels of engagement. Some LPs in the early stages of diverse investing may require advisors for help with sourcing, due diligence, and implementation. Others may play a more active role by participating in deal flow calls to get an advisor’s views on managers, or invest alongside the advisor in its commitment to a particular manager.

GCM Grosvenor has partnered with investors of varying size and resource levels to be complementary to their existing efforts in the space. For example, they partnered with one large U.S. institution by introducing them to managers, providing training, supplementing their team, and helping develop their emerging manager conference. On the smaller side of the spectrum, the firm has worked with investors to access oversubscribed and hard-to-access diverse managers.

The LP must hold its advisor accountable by asking the right questions:

- How many diverse managers did the advisor meet with last year?

- How much capital did it allocate in the past three years?

- Is the advisor acting on behalf of all its clients, or just those that request diversity?

- How diverse is the team itself?

- Which diversity-focused conferences did senior members of the firm attend?

- How many within the organization spend the majority of their time focused on investing with diverse managers?

- What is the advisor’s view on investing with first-time funds?

- Is the advisor adequately evaluating the manager’s performance? 0

Thing You Should Know #4: LPs Can Apply Parts of Their Usual Investment Process to Source and Evaluate Diverse Managers. But There are Some Big Differences, Too.

Diverse managers are not an asset class based on ethnicity or gender. A buyout manager is a buyout manager and is evaluated by investors on the same criteria – alignment, track record, how long the team has worked together, strategy, and potential competitive advantage – and nothing should be compromised. LPs are looking for benchmarked performance and, just because it’s a diverse manager, the standards for underwriting don’t change. 0

That said, there may be nuances in sourcing – how and where investors are finding diverse managers. LPs must be able to sort through complexity to identify and evaluate managers that may lack a long history or typical track record. But that’s a common theme in emerging manager investing broadly. It’s about rolling up your sleeves and doing the work to understand the deals a manager has done and vetting its performance.

Thing You Should Know #5: Diverse Managers Do Not Add Risk.

There isn’t anything unique about the investment risks associated with diverse managers. In general, alternative investments are subject to risks such as strategy risks, manager risks, market risks, and operational risks. Still, investors with diverse managers are often exposed to a different type of risk: perception risk. Some investors and consultants believe there is additional risk in seeking investments with people that are somehow different from them. That is a misperception. Meeting with and evaluating a diverse team is an opportunity, not a risk.

Thing You Should Know #6: LPs Can Help Keep a Fluid Pipeline of Talented Diverse Managers.

When it comes to maintaining a pipeline, LPs should hold themselves and their advisors accountable. It is not about meeting quotas, but LPs may benefit from being more “intentional” in asking themselves questions like: Are we invested with diverse managers who have generated exceptional performance? If not, why not? How many diverse managers have we met with this quarter? And if we’ve not met with many, why not? Who’s in the pipeline? It is critical that an investor, its staff, and advisor leave no stone unturned to find the very best opportunities.

It’s also important that LPs stay connected to the feeding organizations that supply talent, as there is a need for established managers to have their own diversity of staff and promote growth among diverse professionals. Considering that only 20% of employees at alternative investment firms are women, and just 12% occupy senior roles,3 investors should help drive change and influence managers by inquiring about their diversity initiatives and stressing the importance of having an inclusive culture.

GCM Grosvenor hedge funds data as of July 1, 2020. Private equity and real assets commitments as of March 31, 2020.

Investments in alternatives are speculative and involve substantial risk, including strategy risks, manager risks, market risks, and structural/operational risks, and may result in the possible loss of your entire investment. Past performance is not necessarily indicative of future results. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided by parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.

0 Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its objectives or avoid losses.

1 NAIC, “Examining the Returns,” 2019. Full report athttp://naicpe.com/wp-content/uploads/2020/03/2019-NAIC-ExaminingTheResults-FINAL.pdf

2 Bella Research Group and John S. and James L. Knight Foundation

3 Source: Preqin.