An eruption of market volatility in early 2020 touched nearly every corner of the fixed income markets. For institutions, the episode highlighted that the OTC bond market remains relatively opaque and fragmented, despite improvements made in recent years. By contrast, the largest and most heavily traded fixed income ETFs illustrated the important role that they play in both normal and stressed market conditions by providing invaluable price discovery and liquidity. These attributes helped institutional investors understand and navigate rapidly changing market conditions at a time when it was needed most. It also showed that the most heavily traded fixed income ETFs are essential to the functioning of healthy fixed income markets, where buyers and sellers can exchange risk efficiently.

For pensions and insurance companies, fixed income ETFs provided a means to reduce complexity and streamline portfolio construction and risk-management practices. For asset managers, fixed income ETFs served as rapid and efficient tactical allocation tools and as liquidity sleeves to minimize trading frictions and reduce the potential for cash drag.

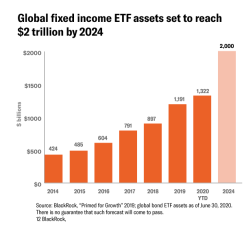

Recent trends underscore BlackRock’s view that institutional investors will propel future fixed income ETF growth, which remains just a fraction of total global fixed income assets. The firm projects that global fixed income ETF assets will double, to $2 trillion, by 2024, aided by the important role that fixed income ETFs are playing in the modernization of fixed income market structure, the evolution of portfolio construction and constant product innovation.9

Indeed, the pace of growth could be faster than we expect. In 2019, when BlackRock first made the projection mentioned, fixed income ETF assets had just crossed $1 trillion. Since then, fixed income ETF assets have grown by more than 30% – nearly all of which was organic growth. As more asset managers and asset owners embrace fixed income ETFs as an efficient, transparent and convenient way to access the bond market – especially in times of volatility – the prospects for growth will only look brighter.

1 BlackRock, Bloomberg (as of May 31, 2020).

2 SIFMA TRACE; BlackRock; Bloomberg; on March 20, 2020, the 20-day average for U.S. high yield bond ETFs reached $7.8 billion compared with $27.4 billion in individual bonds.

3 SIFMA TRACE; BlackRock; Bloomberg; on March 25, 2020, the 20-day average for U.S. investment grade bond ETFs reached $6.9 billion compared with $28.8 billion in individual bonds.

4 BlackRock, Bloomberg (as of May 31, 2020).

5 BlackRock, FINRA TRACE (as of May 31, 2020).

6 Bloomberg, BlackRock (as of May 31, 2020).

7 Bloomberg (as of May 31, 2020).

8 Bloomberg (as of May 31, 2020). I-spread represents the yield spread of EMB relative to the underlying benchmark, USD swaps.

9 BlackRock, “Primed for Growth” 2019; global bond ETF assets as of June 30, 2020. There is no guarantee that such forecast will come to pass.

FOR INSTITUTIONAL INVESTORS ONLY – NOT FOR PUBLIC DISTRIBUTION

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

Shares of iShares ETFs may be bought and sold throughout the day on the exchange through any brokerage account. Shares are not individually redeemable from the ETF, however, shares may be redeemed directly from an ETF by Authorized Participants, in very large creation/redemption units. There can be no assurance that an active trading market for shares of an ETF will develop or be maintained.

Case study shown for illustrative purposes only. This is not meant as a guarantee of any future result or experience. This information should not be relied upon as research, investment advice or a recommendation regarding the iShares Funds or any security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

This material is provided for educational purposes only and is not intended to constitute investment advice or an investment recommendation within the meaning of federal, state or local law. You are solely responsible for evaluating and acting upon the education and information contained in this material. BlackRock will not be liable for direct or incidental loss resulting from applying any of the information obtained from these materials or from any other source mentioned. BlackRock does not render any legal, tax or accounting advice and the education and information contained in this material should not be construed as such. Please consult with a qualified professional for these types of advice.

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Markit Indices Limited, nor does this company make any representation regarding the advisability of investing in the Funds. BlackRock is not affiliated with Markit Indices Limited.

©2020 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

ICRMH1120U-1353108