Investors typically focus on China’s growth that is driven by structural changes, middle-class consumption, and the country’s move up the technology value chain. But the income story is equally important, says Sherwood Zhang, CFA, portfolio manager of the Matthews China Dividend strategy. Dividends also are a way to combat market volatility.

“It is often forgotten that China is the strongest dividend story in Asia,” Zhang says. “H-share payouts have multiplied by a factor of 14 in the past 20 years.”

Chinese companies paid out just $8 billion in dividends in 1998. By 2017, that figure had risen to $114 billion.

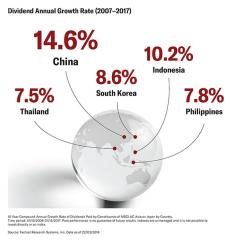

Across Asia, many listed companies are aligning their dividend strategies more closely with shareholder needs, aware that a strong and sustainable payout reflects good underlying capital allocation by company management. Chinese businesses are no different and have led the dividend revolution in the past 10 years. Annualized dividend growth was 14.6% in the decade ending 2017, significantly ahead of South Korea (8.6%) and the rapidly emerging economies of Thailand (7.5%), Indonesia (10.2%) and the Philippines (7.8%).

Matthews Asia has significant experience investing in dividend-paying companies in Asia for over 25 years.

“We run a balanced portfolio of stocks that collect dividends from companies from various sectors, industries and market capitalizations to ensure both stability and long-term growth in dividends,” Zhang says.

The dividend lens

To ascertain the ability of a company to pay growing dividends, Zhang and his team start with fundamentals. They seek companies with strong financials, solid balance sheets, low financial leverage, and improving cash flows and dividend payout ratios.

“Dividends are a lens through which we identify high-quality, financially healthy companies with prudent capital allocation policies,” Zhang says.

Zhang notes that dividends can be a better indicator of business performance than reported accounting growth. A corporate commitment to dividends is an incentive to management to be highly disciplined in the returns they generate on capital invested.

Outlook for dividend growth

Zhang believes Chinese companies will continue to deliver low-teens earnings growth over next two years and that dividend growth should at least be in line. He thinks some of SOEs (state-owned enterprises) might even raise their payout ratio this year to generate revenue to offset the Chinese government’s aggressive tax cut.